By: American Heritage04.20.23

Culture

Earth Day is celebrated by billions of people around the globe each year on April 22. In honor of this year’s theme, “Invest in Our Planet,” we’ve compiled a list of 52 eco-friendly ways you can help the planet every week. These Earth Day ideas can help you conserve water and energy, reduce your carbon footprint, and improve the environment for future generations—plus, they’ll help you save money while you make a positive impact!

Financial literacy is an essential life skill that lays the groundwork for a successful future. As parents, grandparents, or guardians, it’s crucial to teach children about money management since that’s often not covered in schools. To help you guide your little ones on this important journey, we've compiled a list of seven common mistakes to avoid when teaching your kids about money.

By: Nicholas Franks04.06.23

Culture

Spring is here and it’s time to get out to enjoy the warm sun and take in all the activities the greater Philadelphia area has to offer. From attending a sporting event to cultural demonstrations, there’s something for everyone and their families!

Home is where the heart is … and it can also be a valuable source of low-cost funds you can use for just about anything. If you’re a homeowner who’s built up equity in your home, you may have the opportunity to access affordable financing through a home equity loan or line of credit (HELOC). Here are some things to consider before tapping into your equity.

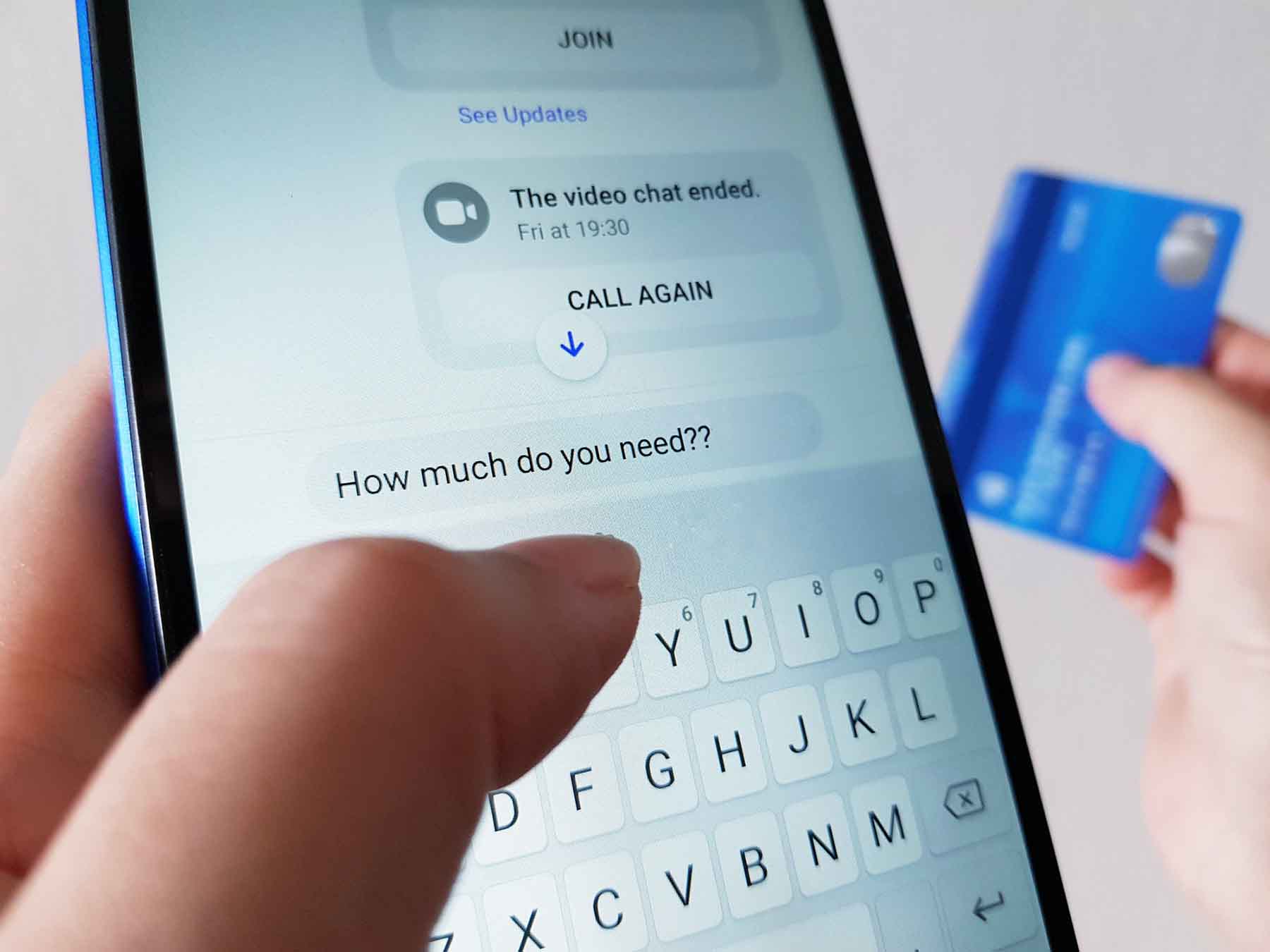

If you’ve been following the news, scams and fraud are seemingly everywhere in our world. Whether over the phone, online, or even in the mail, it seems like there is a new trick to learn every day with regards to fraudsters, and it is important to stay informed about the latest cons to protect yourself and your family.

Traveling can bring excitement, new experiences, and can even help you recharge and reduce stress. But to travel, you’ll need to pay for your trip and expenses that come with it. Travel credit cards are a great option for those looking to earn and redeem points, cash back, and receive valuable perks to help ease travel costs. With many options available to travelers, it’s hard to know which card is your best option. We’ve created a guide to help you determine which type of card best suits your spending habits, travel needs, and expectations.

By: Nicholas Franks03.02.23

Culture

The City of Brotherly Love: the heartbeat of the Delaware Valley which we’ve been tied to since 1948. American Heritage Credit Union is one of the leading financial institutions in the greater Philadelphia area that provides members with full-service banking solutions while continually staying involved with our community. Here are some affordable things that you can do this month with your friends or family for under $60!

Since 2007, America Saves Week has been inspiring people of all ages to commit to building and maintaining good savings habits. This year’s theme is “A Financially Confident You,” and it’s all about taking control of your finances to achieve financial well-being.

In honor of America Saves Week, here are some money-saving tips to help you boost your financial confidence and empower your financial future.

By: Holly Benedetto02.16.23

Auto

A vehicle is no small purchase. Many people will research for hours before making a decision, comparing manufacturers, models, and even dealerships. When doing your research, don’t forget to answer this vital question: when is the best time to buy? By timing your purchase for a sales event, you can save yourself thousands of dollars on the ticket price or interest payments over the life of your loan.

Millions of people use dating apps or social networking sites like Facebook and Instagram in the hope of finding love. But instead of finding their dream person, they wake up to an empty bank account. In fact, in 2021 alone, the Federal Trade Commission said that losses from romance scams were up nearly 80% from 2020, totaling $547 million.

There are lots of things to look out for when it comes to romance and other online scams. In this blog, we’ll look at some different kinds of scams so you can avoid them and the heartache that can come along with them.

Identity theft can be a devastating crime that victims may not notice until it is already too late. Anyone can become a victim of identity theft, but luckily, anyone can take precautions to protect themselves.

The Federal Trade Commission (FTC) and its partners hosted Identity Theft Awareness Week from January 30 through February 3, 2023. Their mission is to raise awareness that any person, of any age or background, can be a target for identity theft.

Soaring home prices over the past few years have caused an interesting side effect – homeowners are finding themselves with a lot more home equity.

Home equity is the difference between your home’s value and how much you still owe on your mortgage. For example, if your home is worth $300,000, and you owe $50,000 on your mortgage, you have $250,000 in equity.

By: American Heritage01.19.23

Credit

Between the rising cost of gas and groceries, holiday expenses, and unexpected bills, chances are your credit card balance may be a little higher than you’d like. Luckily, there’s a simple solution to help you lower your monthly payments and pay off your credit card debt faster: transferring your current balance to a low- or no- interest credit card. Here’s how a credit card balance transfer can help you get a fresh start and give your budget some breathing room in the new year.

By: American Heritage01.12.23

Culture

Each January, we celebrate the wisdom and legacy of Martin Luther King, Jr., whose fight and vision for a better society left a lasting mark on the nation and still inspire many to this day. Though his “I Have a Dream” speech is perhaps his most famous, King gave over 2,500 speeches in his lifetime and was full of powerful truths and beliefs that can guide us toward more meaningful, impactful living today.

To celebrate MLK Day 2023, we have gathered some of our favorite actionable Martin Luther King quotes to help you honor everything he did for our country.

Whether your goal is to save $500 or $5,000, methods used for saving can be easily scaled to accomplish any dream. Developing a plan early into the year can be inspiring, but you don’t need to wait for a new year to get started.

Knowing which products earn the highest dividends will help you reach your goal faster. Depending on your needs, a high yield savings account or certificate are excellent choices for the determined saver.

If you didn’t snag all the Black Friday and Cyber Monday deals you were hoping for — or if you didn’t receive everything on your own wish list over the holidays — don’t worry. There are a ton of awesome shopping deals to be had after Christmas. With some planning, patience, and strategic shopping, you can score deep discounts from both big-box stores and mom-and-pop businesses trying to reduce their inventory and make room for new items in the new year. Here are some savings you can look forward to after Santa returns to the North Pole.

Planning any New Year’s resolutions for 2023? Along with goals like eating healthier and exercising more, money-related resolutions are common. If you’ve committed to tackling debt or saving more in the coming year, that’s great news.

Here’s how you can take this goal even further: Try becoming more mindful about your money. It’s a personal change that could really pay off, and not just financially.

Credit cards come in many different forms from many different lenders. To incentivize borrowers to choose their card, lenders include special perks like low rates or cash back.

If you're looking for a new addition to your wallet, consider diversifying with a card that specializes in cash back. Continue reading to see if the Cash Reward Mastercard® is a good fit for your spending needs.

If it sounds too good to be true, it probably is. If someone asks you to invest and promises impossible returns on your money, such as guaranteeing that your money will be doubled or tripled with no risk, it’s probably a Ponzi scheme.

Knowing how to recognize different types of fraud is a key component to financial literacy. There are many types of investment scams, but one of the most famous is known as the Ponzi scheme.

Credit cards are the most versatile product in your wallet and can be the ticket to a strong credit score and healthy financial habits. By mastering the most popular financial tool, you can demonstrate to lenders that you are a responsible borrower, ushering in new opportunities.

Shopping for a new card? Continue reading to see if the Platinum Preferred Mastercard® is a good fit for your banking habits.