Explore and discover the best ways to master your financial future in our Learning Center!

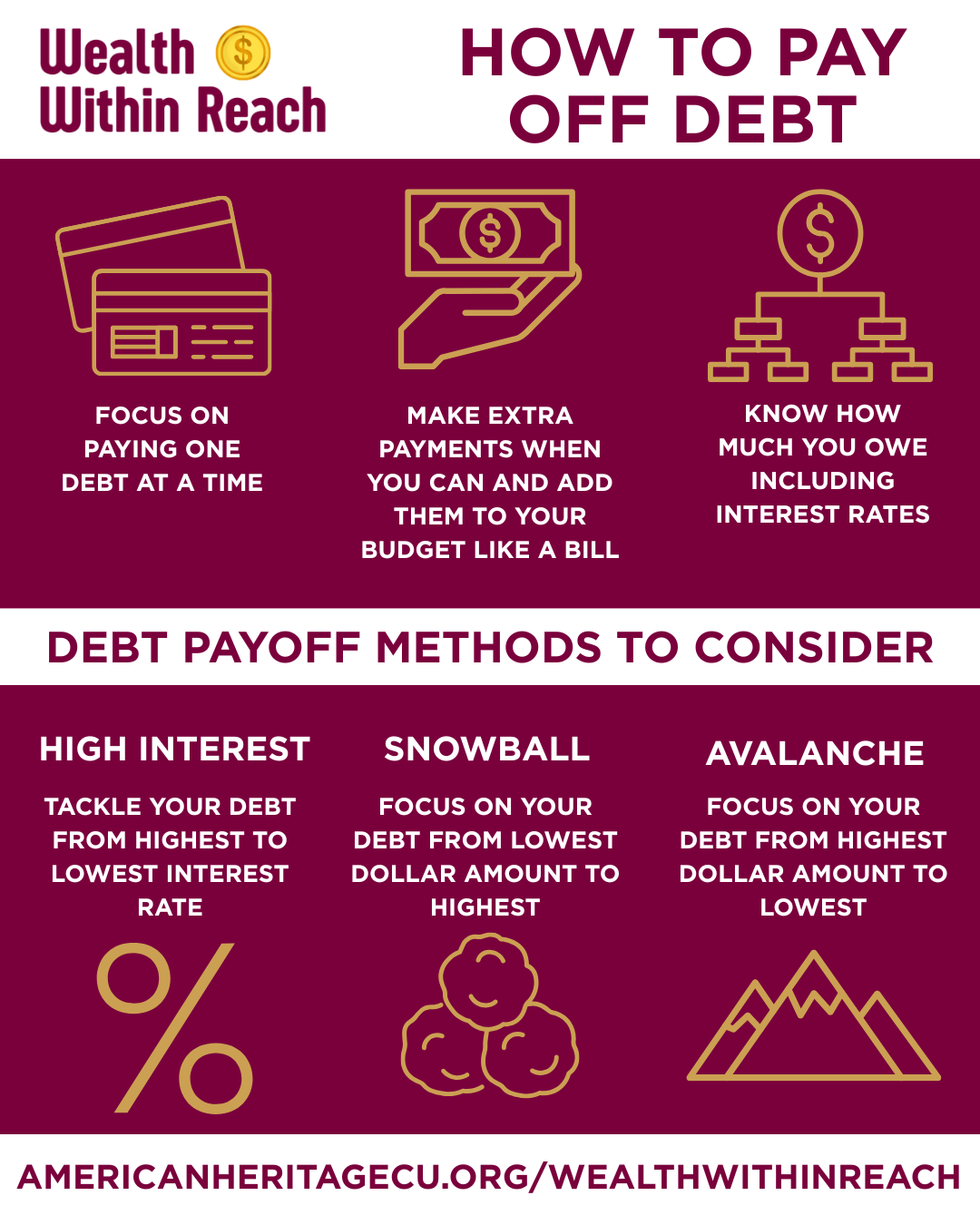

Wealth Within Reach promotes the importance of Financial Wellness in today's society. By highlighting important topics such as budgeting, debt management and planning for financial milestones, we're empowering our members with the educational tools and resources they need to build a more financially secure future.

Helping you Plan for Life Stages

Helping you Plan for Life Stages

Read

Watch

Partner Programs

Money Management International

American Heritage supports community financial literacy programs, helping to market and host seminars for the public and providing valuable educational materials.

Our Money Management International financial literacy partner is a non-profit organization devoted to lifelong financial literacy. Don't let personal finance be a source of stress, make it the engine that drives all of your biggest goals such as college, homeownership, retirement and more! Every dream, big and small, gets a little easier to reach once you have your money under control. Connect with a credit counselor today from Money Management International by clicking here or calling at 866.889.9347.

Get Started with Money Management International