Little Patriots Account (ages 0-4)

- Minimum deposit is $15.

- If you deposit $5 American Heritage will contribute $10 to activate the account.

- Even if you were born yesterday, that's no excuse to not start saving today!

American Heritage is fully committed to helping your child gain important financial literacy skills through workshops, in-branch Teller interactions, and even an account of their own. By introducing age-appropriate, real-life skills, your child can master healthy money habits before they even start their first job.

Children as young as 5 years old have been reported to have an emotional reaction to spending and saving money [1]. These emotional reactions shape financial behaviors in adolescence and adulthood, proving that it's never too early or too late to begin discussing healthy habits. Let every day be a lesson for your child and help them experience the rewards of saving, beyond the piggy bank!

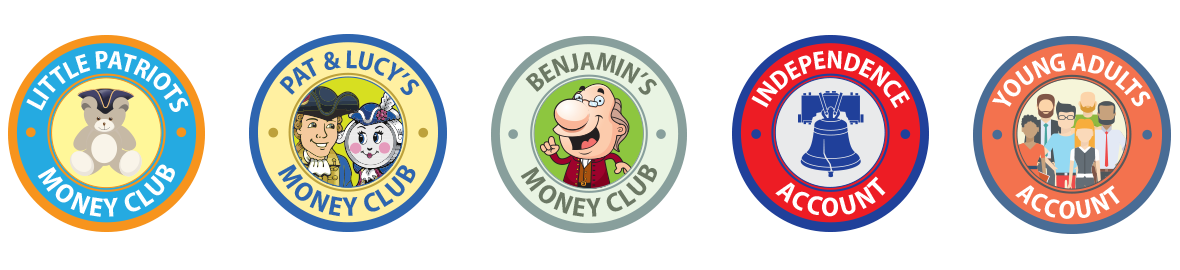

Choose one of our five youth accounts, tailored for five different age groups, and set your child on the path to financial success today!

* Internet service provider fees and 3rd party fees for message and data plans may apply.

The law requires parental consent to collect or use information from a child under 13. If you are a child under 13, please show this to your parents and do not use the online services of this institution without verifiable parental consent pursuant to the Children's Online Privacy Protection Act.