Statement Refresh Status Updates

What You Should Know: Starting in September, you will notice an updated design to your monthly paper and electronic statements. This new and improved design will be easier to read and we are excited for this opportunity to better serve you!

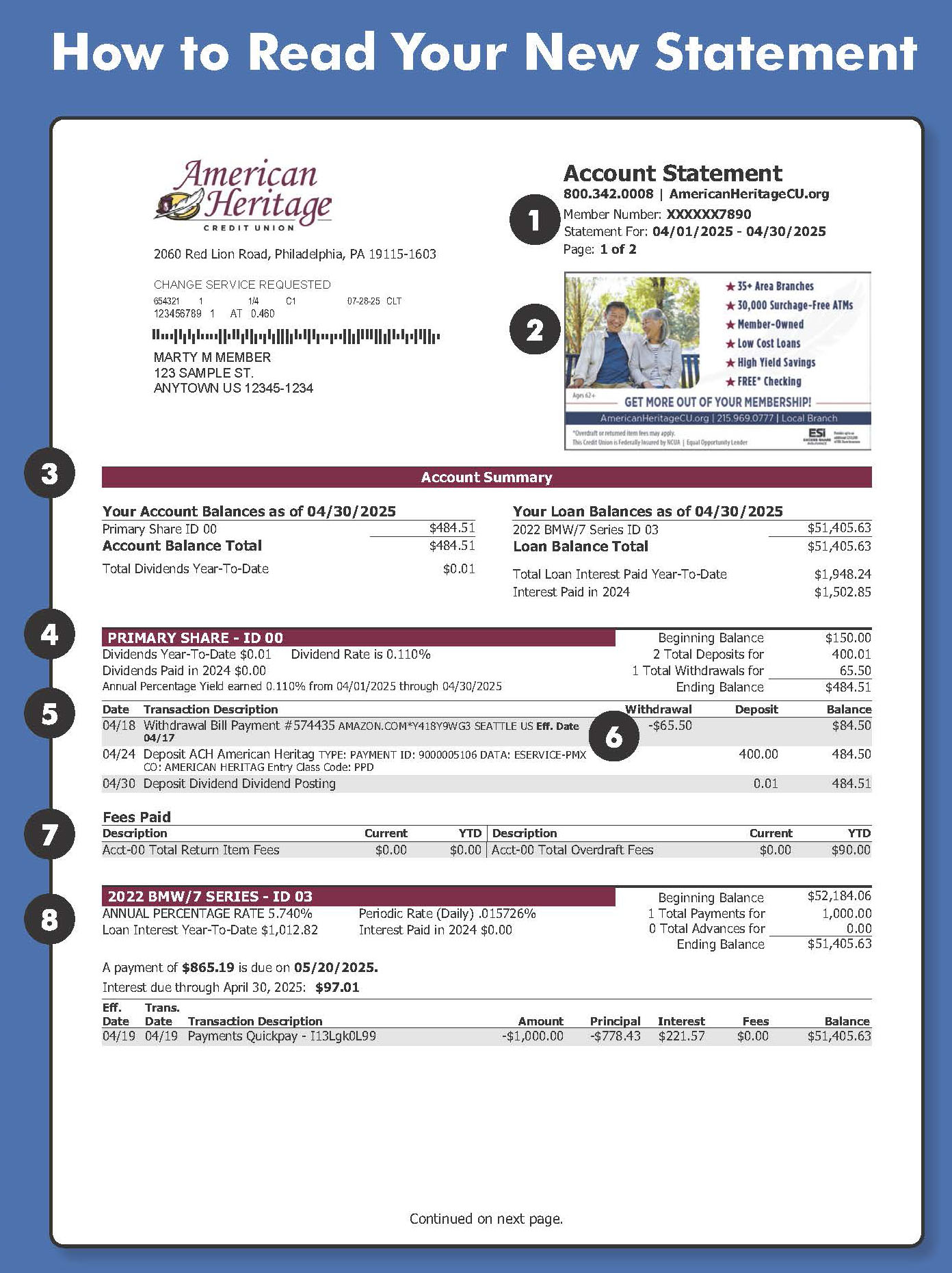

How to Read Your New Statement: Your American Heritage Account Statement has a new look! You’ll notice that we’ve redesigned our Account Statement to make it simple and easy to quickly find the important information you need. Highlighted inside are the new features of our improved statement format.

- Partial display of your Account Number for security; Statement Period Information

- Important messages and/or offers from American Heritage

- Left Side: Deposit Accounts Summary; Right Side: Loan Accounts Summary

- Deposit Account heading with Transaction History Summary and other important information

- Transaction History and Balance columns have been relocated for easier reading

- Effective Date is printed at the end of the Transaction History Description, if different than the Posting Date

- Summary of Fees Paid

- Loan Account heading with Transaction History Summary and Payment Due Date

eStatements

Our eStatements are convenient electronic records of your monthly account activity that are secure and environmentally-friendly. Sign up for eStatements in Online Teller or our Mobile Teller App.

To Make the Switch to eStatements, simply login to your Online Teller account and click on the “eStatement” tab under the “Member Services” tab to enroll today.