Does Money Buy Happiness?

Money can’t buy happiness — is that even true?

When it comes to wealth and well-being, great minds think differently. Arthur Schopenhauer once declared, “Money alone is absolutely good,” while Seneca the Younger cautioned, “Money has never yet made anyone rich.” Perhaps a balanced perspective is needed — and as the legendary financial commentator Louis Rukeyser once quipped, “The best way to keep money in perspective is to have some.”

Indeed, while most research confirms that the constant pursuit of riches leads to diminishing returns, achieving financial stability can definitely make life better. Probably the best-known study on this topic, conducted by Nobel laureates Daniel Kahneman and Angus Deaton, found that Americans’ emotional well-being rises with annual income up to about $75,000, at which point more cash doesn’t equal more laughter or less stress.

Meanwhile, other researchers have discovered that the relationship between money and happiness has less to do with how much you make than what you make of it. Wondering what financial habits are most likely to bring you joy? Here are five smile-inducing strategies to consider:

1. Focus on Doing Things Instead of Having Things

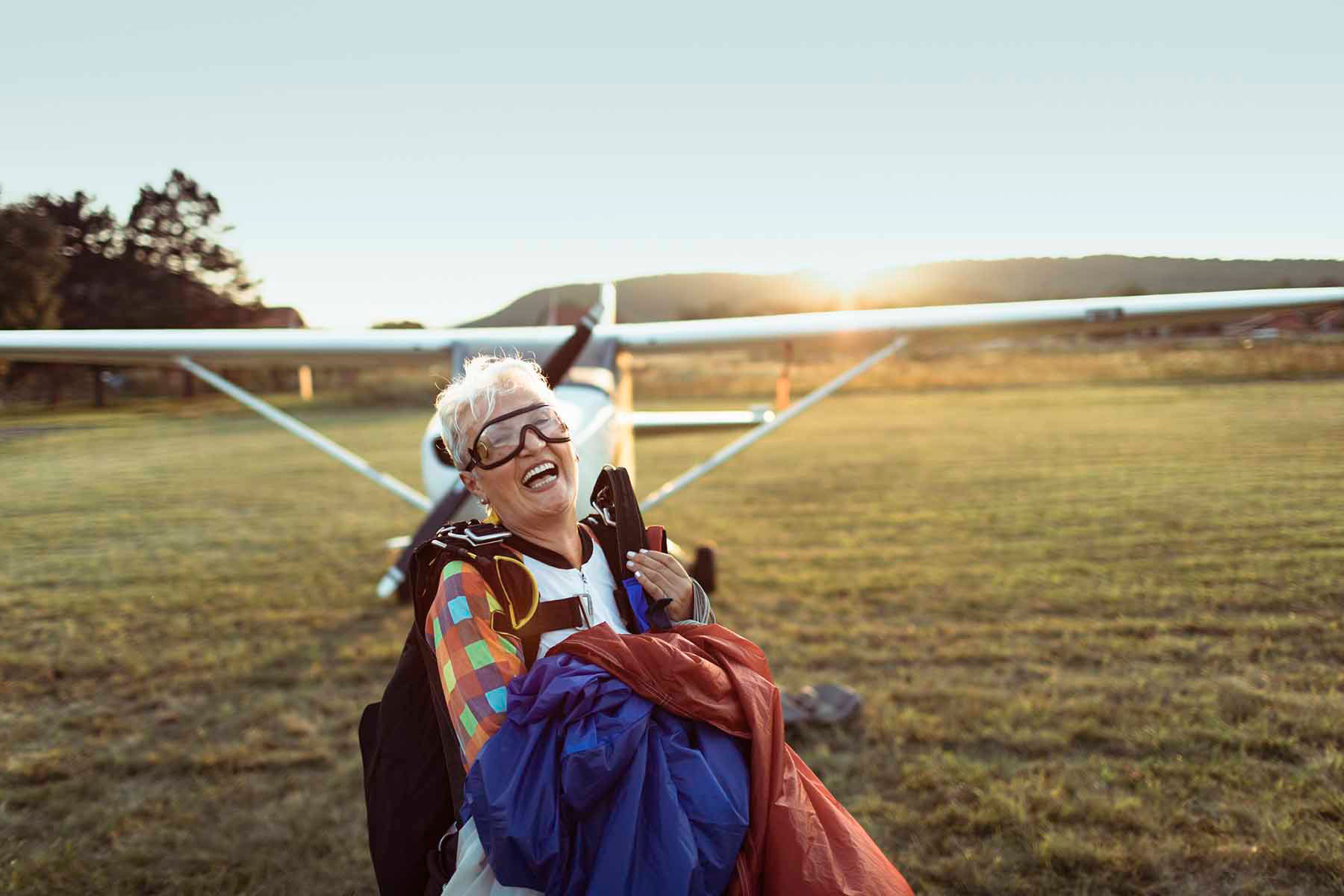

Material objects tend to lose their luster pretty quickly (think about the fancy new car that loses 15% of its value as soon as you drive it off the lot), but experiences can endure and even flourish in our memory. Experiences are more deeply connected to our self-perception, and they can also enhance our personal relationships, which are ultimately the best predictor of happiness.

| 💡 Tip: Ever been a tourist in your own town? Explore these budget-friendly activities in greater Philadelphia. |

2. Give to the People and Causes You Care About

Money is a powerful tool, and one of the most powerful things you can do with it is to promote the happiness of others. If it’s true that extra cash offers diminishing returns, then a little can go a long way for those who are less fortunate. And studies show that when people give gifts and donate to charity, they experience a boost of the feel-good brain chemical dopamine.

| 💡 Tip: Check out this list of local nonprofits that are working to make positive changes in our communities. |

3. Reduce Your Debt Burden

Whether or not you buy into money buying happiness, one thing is for certain: debt multiplies misery. According to the Society of Occupational Medicine, being in debt ranks among life’s most stressful events, and it can take a serious toll on both your mind and your body. Committing to an effective debt payoff plan can have an immediate restorative impact on your well-being.

| 💡 Tip: Try out our debt consolidation calculator to see how much you could save with a lower-interest loan. |

4. Learn Something New

Taking on a new challenge can allow you to enter a rewarding state of mind that psychologist Mihály Csíkszentmihályi termed “ flow.” Getting completely absorbed in a complex activity that stretches your skills is strongly linked to long-term health and happiness. Consider setting aside some of your discretionary income to pick up a new solo sport, musical instrument, or foreign language.

| 💡 Tip: From kickboxing to glassblowing to tango, our region is full of opportunities to develop new skills. |

5. Stop Comparing

Humans are turbocharged comparison machines from the start (just try slicing up birthday cake for a bunch of kindergarteners), but comparing our financial status to those around us is a recipe for heartache. The same goes for endless comparison shopping — it’s good to do your research, but the paradox of choice leaves us less satisfied when we try to evaluate too many options.

| 💡 Tip: Green with envy? Start a gratitude journal and list the possessions and people you’re thankful for. |

Find Your Happy Place Here

As a member-owned cooperative, American Heritage Credit Union is dedicated to offering you the right solutions because you’re family. For more insights on how to bring joy to your financial journey, check out our Learning Center, where you’ll find educational guides, calculators, webinars, success stories, and more.