10 Facts About Gold for Saint Patrick’s Day

This Saint Patrick’s Day, you might be hoping to find your very own pot of gold at the end of a rainbow. Maybe you’re wondering how gold got to be such a hot commodity in the first place.

In this post, we’ll share 10 fascinating facts about this most famous of precious metals, including some tips for those who are curious about gold as an investment.

1. Pots of Gold Are From Stories of Old

Wish-granting leprechauns have been part of Irish folklore for over a thousand years. Their first literary appearance is in the eighth-century Adventure of Fergus mac Léti in which a group of lucorpain grant three wishes to the king. Eventually, these magical beings became associated with pots of gold, as in William Allingham’s 1865 poem that tells of a leprechaun’s “nine and ninety treasure crocks […] full to the brim with gold!”

2. The Story of Gold Goes Back Way Farther

All the gold on Earth is thought to have been produced in supernovas and kilonovas – when massive stars explode and collide. Most of the gold that we’re able to mine from the Earth’s crust was probably delivered via a heavy bombardment of asteroids about four billion years ago. The earliest trove of gold artifacts—including bracelets, buckles, wands, and crowns—dates to around 4400 BCE, and gold has been used as money since at least 600 BCE.

3. Gold Used to Be the Gold Standard

Following centuries of use in coins and other commodity money (a medium of exchange that’s made out of something of value), gold was the basis of the international monetary system for much of modern history up to 1971. Before 1971, if you had a dollar bill, it represented an equivalent amount of gold held by the U.S. government. Now, U.S. dollars and most other world currencies are fiat money (a medium of exchange that’s not backed by a physical asset).

4. Fort Knox Is Still Full of Gold

Even though we’re no longer on the gold standard, the U.S. government still maintains a large gold reserve, most of which is stored at the United States Bullion Depository in Fort Knox, Kentucky. Behind its heavily guarded, two-foot-thick vault doors are high-purity gold bars and coins weighing approximately 4,500 metric tons (or a little over 20 Statues of Liberty) and worth over $280 billion (or a little over the value of every NFL and NBA team put together).

5. Gold Has Tons of Uses

As it was in 4400 BCE, gold is still chiefly prized for its beautiful color and sheen, and its primary application is in jewelry. With 50 million couples tying the knot every year, wedding rings alone account for a substantial share of global demand. However, gold is also needed to produce corrosion-free electrical connectors, protective shielding for satellites, nanoscale drug delivery systems for cancer treatment, and countless other modern technologies.

6. Gold Is a Sought-After “Safe Haven”

For many savvy investors, gold has never lost its luster. Like other commodities, the price of gold is driven by supply and demand, but gold is distinctive in that it’s saved and traded much more than it’s produced and consumed. Consequently, gold doesn’t follow all the ups and downs of other markets, and historically, it has often served as a “safe haven” investment in periods of economic uncertainty as well as a hedge against inflation.

7. All That Glitters Is Not Gold

With investment, there’s no reward without risk, and gold is no exception. While gold can be a safe haven, it’s not immune to a reversal of fortune. For example, between 2011 and 2020, the price of gold went from $1,800 per ounce down to $1,100 and then back up to $1,800. Rather than putting all your golden eggs in one basket, most financial experts would advise you to consider investing in gold as one small component of a well-rounded portfolio strategy.

8. Gold Scams Are on the Rise

Have you seen those “cash for gold” ads everywhere? Recently, there’s been a surge of companies offering to buy gold jewelry or sell stocks in gold mines—and many are now under investigation for money laundering and fraud. There are also “high-yield investment programs” that are really dressed-up pyramid schemes and “brokering opportunities” that are really preludes to identity theft. As with any financial venture, it pays to be wary of unsolicited offers and do your research.

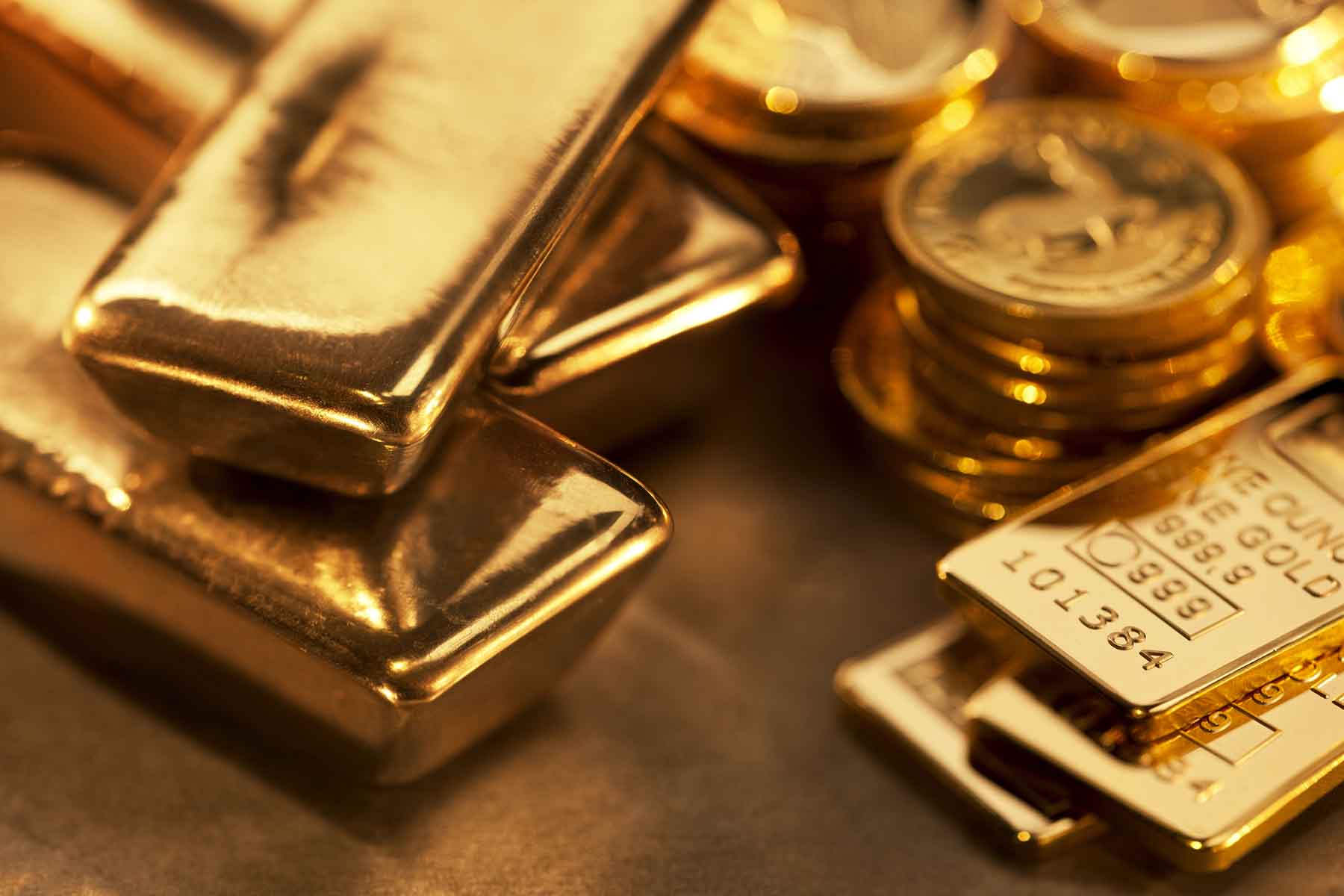

9. Genuine Gold Investments Abound

Interested in diversifying your portfolio with gold? There are many approaches to explore. If you want the full sensory experience, buying gold bars or coins can be an appealing option. If you don’t want to worry about guarding your treasure, look into specialized exchange-traded funds (ETFs) that enable you to buy and sell shares of gold. There are even IRAs that let you save for your golden years by investing pretax dollars in bullion held by an IRS-approved depository.

10. American Heritage Can Help You Go for Gold

From gold to life insurance to tax-advantaged annuities, the experienced professionals at American Heritage Credit Union’s Investment & Retirement Center (IRC) are here to help you plan and save for the future you want and deserve. Your dedicated advisor will take the time to understand your goals, make personalized recommendations, and offer resources for continuous learning. What’s more, it’s free to set up a consultation. Get started today!