Tax Time Tips for American Heritage Members

With Tax Season upon us, here are several tips and offers to help you make the most of your tax return and refund!

The fastest way to receive your tax return is to set up direct deposit for your American Heritage account. All you need is our routing number 236082944 and your account number. Of course, you can always visit a local branch to deposit your refund check.

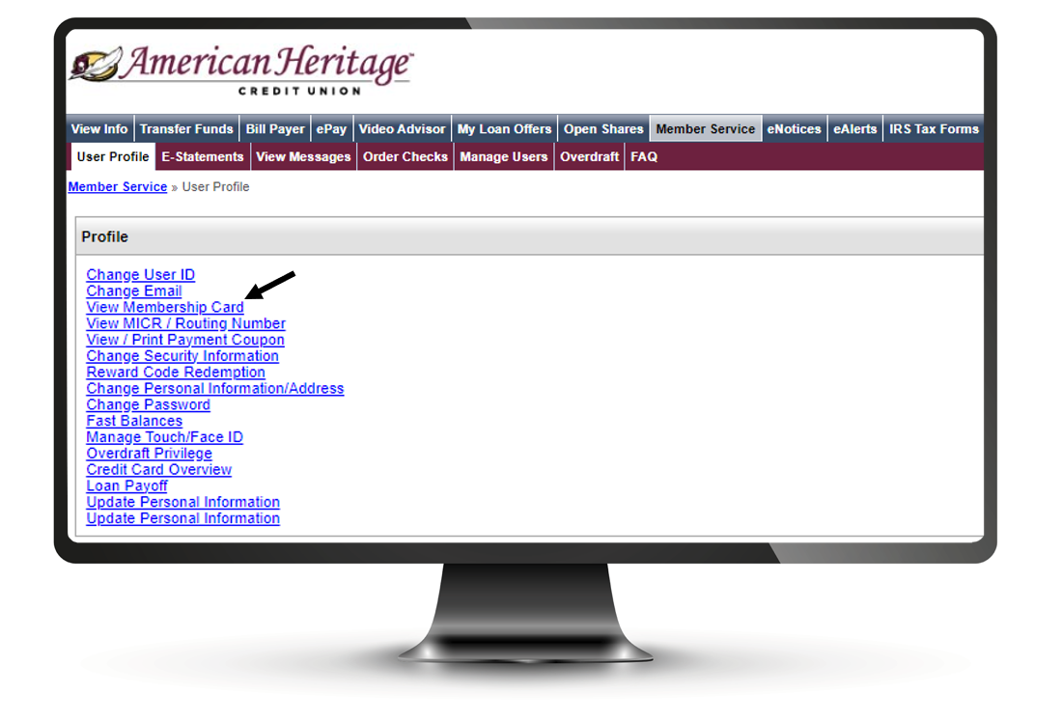

| You can find your full 13-digit account number on your checks or on Online Teller under the “Member Service” tab. To find your account number on our Mobile Teller app, click "More" then "View Membership Card." |

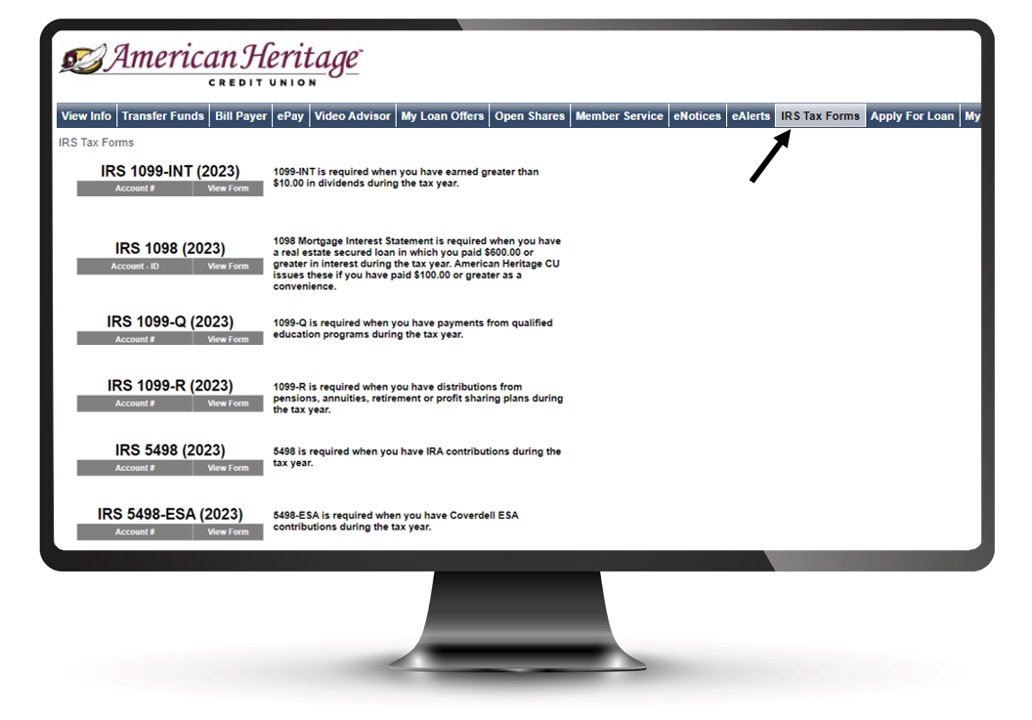

Access Your Tax Forms

You can also access important IRS Tax Forms on your online account. These form are located under the "IRS Tax Forms" Tab of your Online Teller account page. You can view and download the documents that apply to you from this page.

New IRA Contribution Limits

The IRS has increased the Traditional and Roth Individual Retirement Account (IRA) contribution limits effective 1/1/2024. The new amounts can be found here. Here's a quick look at the basics — remember that contribution limits are shared between Traditional and Roth IRAs:

Traditional IRA Income and Contribution Limits for 2023 and 2024

Filing Status | 2023 Income Range | 2024 Income Range | Deduction Limit |

| Single or head of household (and covered by retirement plan at work) | $73,000 or less | $77,000 or less | Full deduction |

| More than $73,000 but less than $83,000 | More than $77,000 but less than $87,000 | Partial deduction | |

| $83,000 or more | $87,000 or more | No deduction | |

Married filing jointly (and covered by retirement plan at work) | $116,000 or less | $123,000 or less | Full deduction |

| More than $116,000 but less than $136,000 | More than $123,000 but less than $143000 | Partial deduction | |

| $136,000 or more | $143,000 or more | No deduction | |

| Married filing jointly (spouse covered by retirement plan at work) | $218,000 or less | $230,000 or less | Full deduction |

| More than $218,000, but less than $228,000 | More than $230,000, but less than $240,000 | Partial deduction | |

| $228,000 or more | $240,000 or more | No deduction | |

| Married filing separately (you or spouse covered by retirement plan at work) | Less than $10,000 | Less than $10,000 | Partial deduction |

| $10,000 or more | $10,000 or more | No deduction |

ROTH IRA Income and Contribution Limits for 2023 and 2024

Filing Status | 2023 Income Limits | 2024 Income Limits | Contribution Limits |

| Single, head of household, or married filing separately and you did not live with your spouse at any time during the year | Less than $138,000 | Less than $146,000 | 2023: 2024: |

| More than $138,000 but less than $153,000. | More than $146,000 but less than $161,000 | Reduced contribution | |

$153,000 or more | $161,000 or more | Contribution not allowed | |

| Married filing jointly or qualifying widow(er) | Less than $218,000 | Less than $230,000 | 2023: 2024: |

| More than $218,000, but less than $228,000 | More than $230,000 but less than $240,000 | Reduced contribution | |

| $228,000 or more | $240,000 or more | Contribution not allowed | |

| Married filing separately (if you lived with spouse at any time during year) | Less than $10,000 | Less than $10,000 | Reduced contribution |

$10,000 or more | $10,000 or more | Contribution not allowed |

Filing Your Taxes

If you are filing your taxes as an individual, you can choose between two filing services provided at cost to you through IRS Free File: Guided Tax Software or Fillable Forms. If you have an adjusted gross income of $79,000 or less, you can qualify for the Guided Tax Software through a trusted partner of the IRS to receive federal and state tax preparation to complete your free federal tax return. Regardless of your income, the IRS has free fillable forms that walk you through the electronic process of federal tax filing.

As a member of American Heritage, you’ll also have access to our tax filing discounts with TurboTax ® & H&R Block.

Protecting your Information

Remember, the IRS and state tax authorities will never reach out by phone, email, text, or through social media to ask for personal or financial information or demand immediate payment. They also will not require that taxes be paid with a prepaid/reloadable debit card, gift card, or money wires through services like Western Union or MoneyGram.

Here are a few tips to help you avoid a tax scam:

- Never reply to any emails regarding your federal or state tax returns/bills

- Don’t provide personal information via any such emails

- Forward any tax scam emails to phishing@irs.gov

- Delete the email

If you're looking for more ways to boost your security during this hot time of year for scammers, check out these tips.

Savings and Retirement

We have several IRA specials for your shorter, intermediate or long-term retirement needs. Our IRAs range from 3 to 60-month terms and feature competitive IRA rates that can help you reach your savings goals faster!

Don't forget, Traditional IRA as well as Roth IRA contributions must be made by the April tax deadline of any given year. The due date for taxes and IRA contributions this year is Monday, April 15, 2024.

Still deciding whether a Traditional or Roth IRA is right for you? Here's the breakdown.

If you’re unsure where to start when it comes to investing your tax return or how to transfer your savings into an IRA account, speaking to an investment and retirement professional can be a great place to start. Our Investment and Retirement Center has financial advisors who can help you understand the ins and outs of retirement planning and can help you navigate the path to financial independence.